In the rapidly evolving world of blockchain gaming, we stand at the precipice of a revolution that promises to redefine the gaming industry. As digital realms become increasingly intertwined with real-world value, blockchain technology heralds a new era of gaming where cross-game integration, tokenization, and the creator economy are not just possibilities—they are inevitable realities. This exploration delves into the token landscape underpinning blockchain gaming today and the role of tokenization across the gaming tech stack. As we chart the course of investment opportunities and the long-term potential of blockchain games, we unveil a future where gaming is not only an immersive experience but also a platform for the distribution of value. Join us as we navigate the dynamic landscape of blockchain gaming, where every decision could lead to the next breakthrough in how we play, create, and fund the games of tomorrow.

This blogpost focuses on the realm of fungible tokens within blockchain gaming; while NFTs, encompassing unique in-game items and virtual real estate in metaverses also capture value in blockchain gaming ecosystems, they fall outside the purview of this particular analysis. Before delving into the tokens across the blockchain gaming tech stack, it is essential to understand the factors that imbue tokens with value. A token’s intrinsic value springs from its utility, such as its role in facilitating usage fees on a blockchain or, in certain cases, empowering holders to influence governance decisions within a project through a DAO, including decisions on resource allocation. Some tokens also have explicit value-accrual mechanisms, such as ETH after the August 2021 implementation of Ethereum Improvement Proposal 1559 (EIP-1559). This proposal allocated a significant portion of network fees—typically, 30% to 80%—to buy-back and “burn” tokens issued to network validators, reducing the supply similar to corporate share buybacks. During periods of high activity, this can lead Ethereum to experience deflationary phases as more tokens are burned than issued. The value of fungible tokens, akin to commodities, hinges on supply and demand dynamics, with buy-back and burn mechanisms potentially exerting upward pressure on prices. Another value accrual method involves directly distributing a portion of network fees to tokenholders.

It is crucial to acknowledge that current token demand largely stems from speculation on future values rather than these fundamental mechanisms. Similar to equities, token demand is often propelled by narrative-driven speculation, with themes such as artificial intelligence boosting demand regardless of immediate fundamental value drivers. However, unlike equities, where sophisticated investors may scrutinize the alignment between company fundamentals and narratives, token demand is predominantly narrative-led. In the long-term perspective, we anticipate tokens will be traded like any other asset class. Thus, our upcoming discussion will concentrate on understanding what drives fundamental token demand within the blockchain gaming ecosystem.

The Token Landscape Underpinning Blockchain Gaming Today

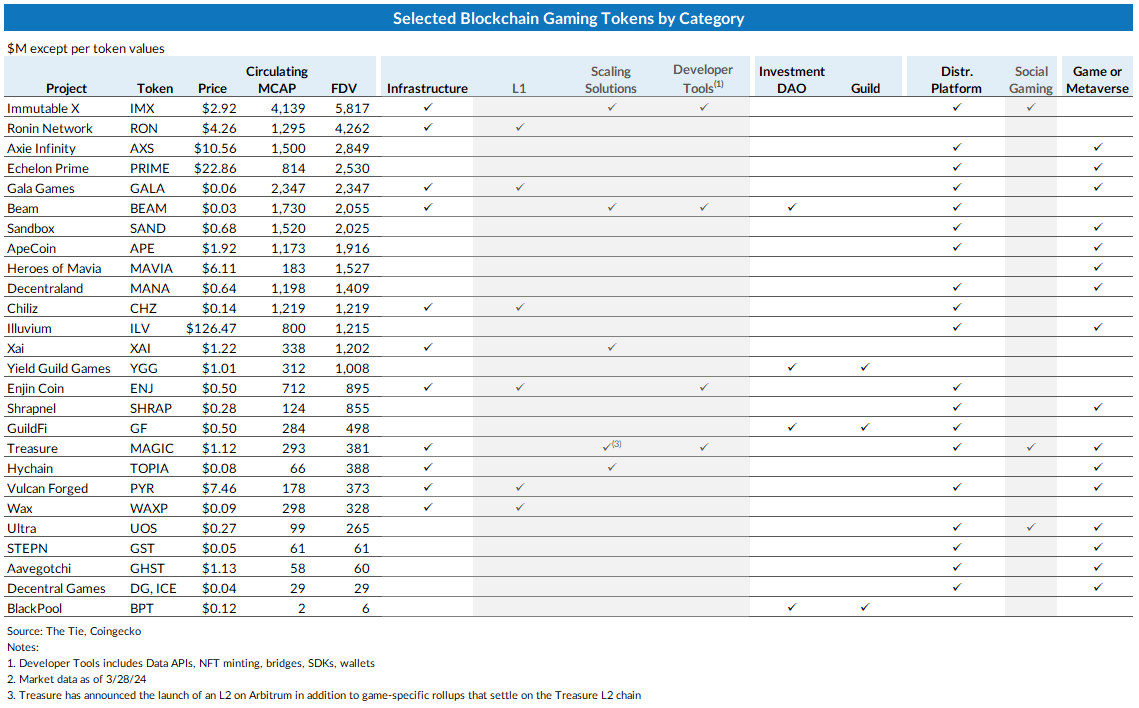

In the dynamic arena of blockchain gaming, the spectrum of investment opportunities with fungible tokens extends from foundational platforms and “pick-and-shovel” infrastructure projects to the more speculative individual game ventures. We categorize these investment avenues into key segments: infrastructure, distribution platforms, investment DAOs or guilds, and games or metaverses. This classification serves as a guide to navigating the varying degrees of investment risk, positioning infrastructure as the bedrock with comparatively lower risk, while individual games present a higher gamble due to the unpredictability of their success.

From a tech investor’s perspective, it is crucial to recognize that, mirroring practices in the traditional gaming industry, the inclination is towards putting capital into gaming studios or platforms rather than single game titles. This strategic approach is rooted in the quest for scalable and replicable ventures that promise significant ROIC. Investing in a studio or platform not only diversifies risk but also opens up a portfolio of potential revenue streams across multiple games and ancillary services, offering a more balanced investment profile.

As we unpack in the subsequent analysis, these investment segments are intricately linked rather than isolated, painting a picture of a complex and intertwined ecosystem where risk and opportunity intersect across the blockchain gaming tech stack.

Infrastructure Tokens

Infrastructure tokens form the bedrock of blockchain gaming, encompassing both Layer 1 (L1) blockchains and their scaling solutions, along with a suite of indispensable developer tools. The necessity for this infrastructure cannot be overstated; the transaction costs associated with general-purpose L1 blockchains such as Ethereum can be prohibitively high for the relatively modest transactions typical in gaming scenarios. Herein lies the genius of lower-cost L1 solutions and L2 scaling technologies, which come in two flavors: versatile systems such as Avalanche and Polygon, designed to serve a broad spectrum of applications through a network of customizable subnets, and those meticulously crafted for gaming, including appchains like Merit Circle’s Beam (1), Immutable X’s zkEVM, and specialized L1s like WAX or Ronin Network. This sector extends into a comprehensive array of gaming-specific tools—encompassing everything from NFT minting platforms to exchanges, bridges, wallets, data APIs, and SDKs—each integral to weaving decentralized ownership into the gaming fabric.

From an investment standpoint, infrastructure tokens represent a particularly compelling entry point into the blockchain gaming tech stack, offering broad market exposure with a relatively lower risk profile. The intrinsic value of these tokens is bolstered by their critical role in network operations, from fee payment to facilitating transactions across myriad gaming platforms. It is worth noting, however, that the above summary table selectively omits tokens associated with general-purpose L1 blockchains like Ethereum, Avalanche, Aptos, Sui, and Polygon, despite their significant role in hosting an array of blockchain games. This choice is deliberate, reflecting their expansive TAM that spans far beyond gaming to include a wide array of decentralized applications. Our focus remains sharply on those tokens and platforms with a direct, undeniable tether to the gaming sector.

Distribution Platforms

In the fast-evolving landscape of blockchain gaming, distribution platforms emerge as pivotal hubs, blending the functionality of digital marketplaces with the engagement dynamics of social media. Unlike traditional ecosystems, where games often rely on centralized platforms for distribution, blockchain gaming introduces a paradigm where each game frequently boasts its own dedicated distribution platform. The lifeblood of these platforms is the tokens used to transact in-game assets, be they fungible tokens for in-game currencies or non-fungible tokens (NFTs) representing unique in-game assets. Yet, the decentralized, permissionless nature of blockchains introduces a twist: these assets can often be traded across various platforms, from general-purpose exchanges to specialized NFT marketplaces, challenging the notion of platform loyalty and token demand.

Recognizing this, forward-thinking projects such as Treasure, Immutable X, and Ultra are redefining what a distribution platform can be. By weaving social media functionalities directly into their ecosystems, they not only facilitate the buying and selling of in-game assets but also foster communities, dialogue, and connection among players, mirroring the success of traditional platforms like Steam. This integration of social elements is not just an added feature; it’s a strategic move to cultivate user engagement and loyalty, which should translate into sustained demand for the platform’s native token.

Investment DAOs and Guilds

Investment DAOs have carved out an important niche within the blockchain gaming ecosystem, mirroring the role of venture capital firms but with a twist unique to the decentralized nature of the technology they invest in. In the blockchain gaming sector, these entities are not just investors; they are integral parts of the ecosystem’s fabric, providing capital, players, and infrastructure support to gaming projects. Notably, entities like Merit Circle extend their influence through direct involvement in infrastructure projects such as Beam, a subnet built on Avalanche, while platforms like YieldGuildGames, GuildFi, and BlackPool innovate by operating guilds. These guilds lease in-game assets to players, creating a novel revenue stream by sharing in the players’ in-game successes.

The governance tokens of these investment DAOs serve dual purposes: they are tools for decision-making that are proportional to one’s ownership of all tokens, allowing tokenholders to steer the DAO’s strategic direction, including treasury management and investment choices. They also act as a means to participate directly in the financial success of the DAO’s investments, with some organizations opting to buy back tokens using proceeds from their successful ventures. This close relationship with both game developers and the player base provides investment DAOs with unparalleled insights, allowing them to make informed decisions that align with the ecosystem’s growth trajectories. For investors looking to diversify their portfolios within the blockchain gaming space, investment DAO tokens offer a unique vantage point, encapsulating broad exposure to the sector’s innovative and rapidly evolving landscape.

Games or Metaverses

Navigating downstream from the foundational layers of blockchain gaming, we arrive at the fungible tokens in the games and metaverses themselves. These tokens are the currency of in-game economies, where their value and issuance are intimately tied to the gameplay itself. The economic principle is straightforward yet compelling: assuming fixed token supply, as a game or metaverse’s assets become more coveted, the in-game currency used to acquire these assets becomes increasingly valuable. This dynamic is predicated on the delicate balance between currency issuance and the mechanisms (or “sinks”) designed to regulate its circulation, echoing the complex fiscal management seen in real-world economies.

Creating an engaging in-game economy is akin to walking a tightrope, where the equilibrium of supply and demand is constantly at risk. Developers are tasked with the critical challenge of rewarding player investment without saturating the market or undervaluing achievements through scarcity or overabundance. This economic engineering is pivotal in maintaining an environment that both captivates and sustains its player base.

Metaverses such as Decentraland, The Sandbox, and Somnium Space, with their expansive natures, theoretically have the potential to mirror the multifaceted investment opportunities seen in broader blockchain infrastructure, investment DAOs, guilds, or distribution platforms, offering “multiple shots on goal.” Yet, the reality for blockchain-based metaverses has been a struggle to capture the massive user engagement seen in their traditional gaming counterparts like Roblox or Minecraft, each boasting daily active users in the tens of millions. This observation underscores a pivotal challenge for the blockchain gaming sector: bridging the gap between the innovative potential of decentralized virtual worlds and achieving the widespread, mainstream adoption that fuels thriving digital economies.

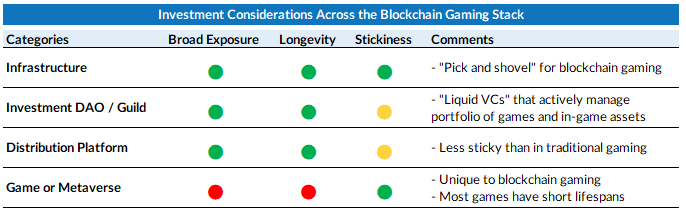

In navigating the intricate layers of the blockchain gaming stack, investors must weigh a multitude of factors to discern the most strategic entry points for capital allocation. The following exhibit provides a structured analysis of investment considerations across various categories within the blockchain gaming landscape. It assesses each category based on broad market exposure, the potential for longevity, and the degree of user stickiness—each a crucial indicator of investment viability.

The Roll of Tokenization in Blockchain Gaming

Tokenization stands as a transformative force within blockchain gaming, ushering in a new era where digital assets gain unprecedented value and utility. By converting in-game items, currencies, and even gameplay achievements into tokens on the blockchain, players can own, trade, and invest in these digital properties as never before. This paradigm shift not only enhances the gaming experience by adding layers of economic interaction and player agency but also fosters a vibrant, decentralized marketplace. Beyond the immediate gaming landscape, tokenization paves the way for innovative economic models, enabling creators and players to partake in the game’s success. As we delve deeper, we will explore how tokenization is redefining value creation, distribution, and ownership in the gaming world, and the implications it holds for developers, players, and investors alike.

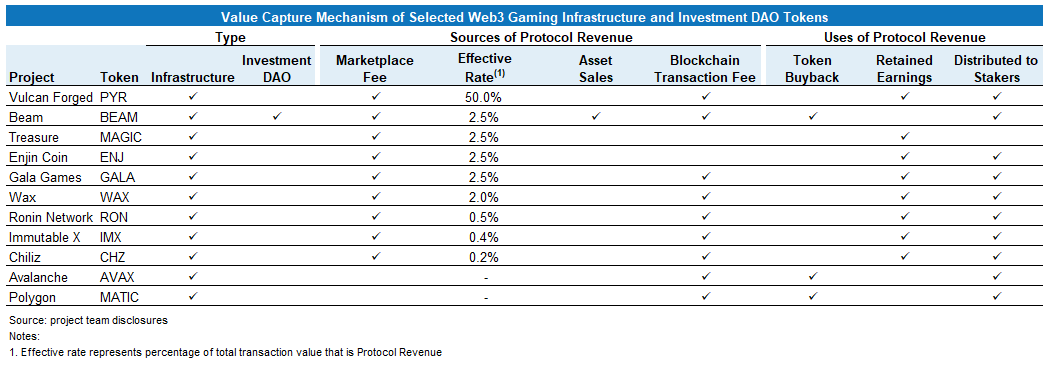

In the blockchain gaming economy, infrastructure and investment DAO tokens play pivotal roles in the value distribution network. Infrastructure tokens, serving as the backbone, facilitate transactions on decentralized marketplaces like Immutable X, Treasure, and Enjin Coin, or cover transaction fees (aka “gas” fees), on networks such as Beam. The economic model of marketplaces is based on transaction fees, which are typically a modest percentage of the transaction value–typically, 5% or less, which is much lower than the take-rates of centralized distribution platforms such as Steam, the Epic Games Store, or the Apple App Store, which can range from 15% to as much as 30%. Tokenholders often reap benefits from these fees, which are redistributed either through token burn strategies—echoing the share buyback schemes of traditional public equities—or by accruing to a treasury managed by a DAO or a non-profit foundation dedicated to ecosystem growth. Where DAOs govern these protocols, tokens not only carry economic weight but also grant voting power, influencing treasury allocations. However, an astute investor should be aware that core teams or VCs frequently retain significant, and sometimes controlling, voting interests.

These infrastructure tokens, in some cases, also accrue value when staked in a Proof-of-Stake (PoS) system, playing a crucial role in securing network integrity by determining the validators responsible for transaction verification and block production. While this function is indispensable for PoS blockchain operation, from an investment standpoint, only non-inflationary staking rewards truly capture token value. Inflationary rewards are otherwise just a hedge against dilution, maintaining a validator’s relative stake. Yet, there are notable outliers, such as Immutable X’s validium system, where staking is a prerequisite for earning a non-inflationary cut of marketplace fees, a direct value proposition for tokenholders.

In parallel, investment DAO tokens are another instrument of value capture, aligning the returns of investment DAOs with tokenholder interests. Whether through direct actions like token buybacks, or by funneling profits into a DAO-controlled treasury for future reinvestment, these tokens entrench their holders in the financial success of the DAO’s investment strategies. In essence, these investment mechanisms offer a sophisticated blend of direct financial return and governance influence, marking an evolution in asset class utility for discerning blockchain investors.

Conclusion

As we have traversed the landscape of investment opportunities across the blockchain gaming investment stack, from the solidity of infrastructure to the emergent potential of game experiences, we have illustrated the diverse profiles of risk and reward that these segments present. Recognizing the parallel with traditional gaming investment strategies, it is evident that the preference leans toward platforms and studios—repositories of scalable, repeatable successes—rather than the volatility tied to individual titles.

With this foundation in place, our forthcoming blog post will pivot to the horizon, where the potential of blockchain games looms large. We will delve into the transformative models that these games are introducing into traditional gaming, models that promise not just incremental changes but a redefinition of gameplay, economics, and community engagement.

Notes:

1. At the time of writing this blogpost, ProtoCap was an active investor in the following tokens mentioned in this article: Beam (BEAM), Polygon (MATIC).

Disclaimer:

Unless otherwise indicated, the views expressed in this post are solely those of the author(s) in their individual capacity and are not the views of ProtoCap Management LLC or its affiliates (together with its affiliates, “ProtoCap”). Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by ProtoCap. ProtoCap believes that the information provided is reliable but has not independently verified the non-material information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. This post may contain links to third-party websites (“External Websites”). The existence of any such link does not constitute an endorsement of such websites, the content of the websites, or the operators of the websites. These links are provided solely as a convenience to you and not as an endorsement by us of the content on such External Websites. The content of such External Websites is developed and provided by others and ProtoCap takes no responsibility for any content therein. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in this blog are subject to change without notice and may differ or be contrary to opinions expressed by others.

The content is provided for informational purposes only, and should not be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice. You should consult your own advisors for those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by ProtoCap, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. This blog does not constitute investment advice or an offer to sell or a solicitation of an offer to purchase any limited partner interests in any investment vehicle managed by ProtoCap. An offer or solicitation of an investment in any ProtoCap investment vehicle will only be made pursuant to an offering memorandum, limited partnership agreement and subscription documents, and only the information in such documents should be relied upon when making a decision to invest.

Past performance does not guarantee future results. There can be no guarantee that any ProtoCap investment vehicle’s investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. As a result, an investor could lose all or a substantial amount of its investment. Investments or products referenced in this blog may not be suitable for you or any other party.