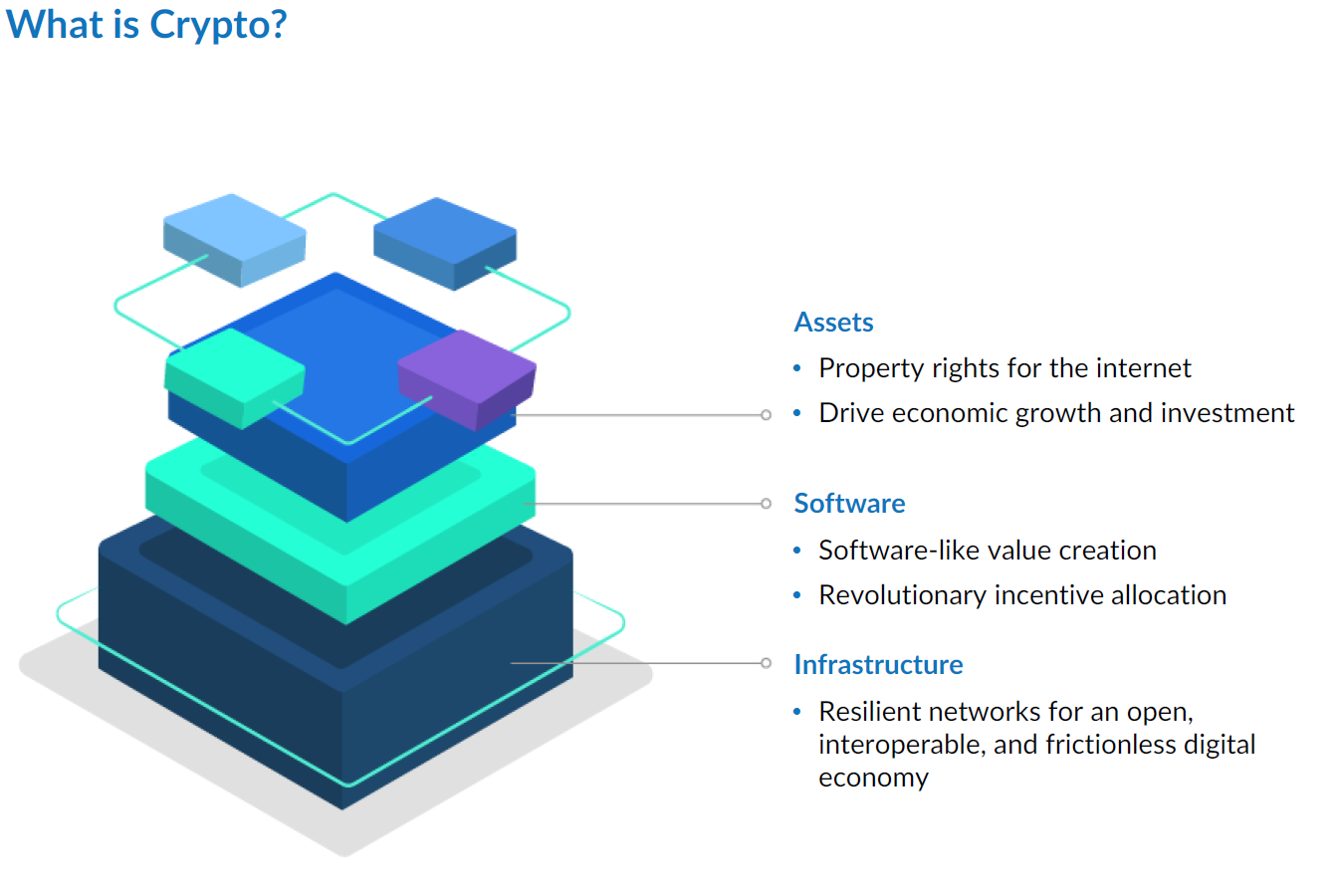

Crypto As Assets

Crypto introduces property rights to the internet, a global economy of over 5 billion users. Robust property rights are widely recognized as being inextricably linked to economic growth. We believe the individual ownership of data and other digital assets, such as cryptocurrencies and NFTs secured by permissionless and decentralized ecosystems will drive significant economic growth and investment in the global digital economy.

Crypto As Software

Crypto’s method of value creation closely resembles that of the traditional software business model.

Like software, crypto protocols have the potential to generate recurring revenue and high margins with low capital intensity in large, global addressable markets.

We believe this process will result in sustainably high growth and high returns on invested capital over time.

Crypto’s key innovation to the traditional software business model is its revolutionary incentive allocation.

We believe crypto protocols can incentivize deeper economic participation and distribute value more evenly across a broad range of stakeholders. Over time, we believe this superior value proposition will lead to crypto’s widespread adoption, as users, developers, and content creators adopt economic models enabled by crypto protocols.

Crypto As Tech Infrastructure

Crypto is the technology infrastructure of the new digital economy. Well-designed crypto protocols are resilient, decentralized networks that enable an open, interoperable, and frictionless digital economy. In less than a decade, we have seen four important and fast-growing segments emerge using this architecture: DeFi, Web3, Metaverses, and NFTs.

Our Thesis

We believe crypto protocols are growth assets that will disrupt critical elements of the internet economy, financial markets and software businesses, among other segments.

We also believe investing in crypto presents unique challenges that require a new investment framework and repeatable process in order to maximize returns.